To start, you have to understand what a "pip" is. A pip is the last number to the right in a currency. For example: If the EUR/USD traded at 1.1335 this morning. The "5" is the pip. If it moved to 1.1535, which it did today, that would be a 200-pip move.

The next concept that you need to understand is the concept of leverage. It’s a lot like margin in stock trading, only on steroids. It’s a simple concept. If you have $10,000 to trade with, your forex broker will let you borrow money from him so that you can trade in larger quantities. They will let you borrow as much as 400 times (400:1) what you put up in a trade. Most brokers allow between 50:1 and 100:1 margin. So, if you put up $1,000, and your broker allows 100:1 margin, then you’ll be trading $100,000 worth of currency (instead of $1,000).

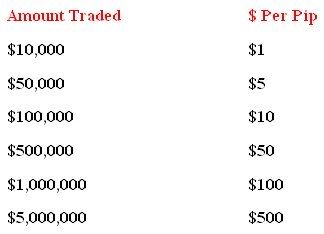

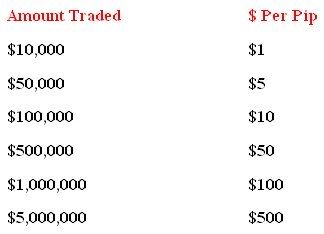

That’s important, because every pip equals a certain dollar amount. When you trade $10,000, each pip movement equals $1. The chart below shows how it goes from there.

If you trade 1,000,000 worth of currency, each movement would be equal to $100. So if you bought at 1.1445 and sold at 1.1545, you would make 100 x $100, or $10,000. Now, I don't know about you, but I could live off of that much.

That's not saying, however, that you can make $10,000 per day. Of course it's possible, but there are a lot of factors that make it very difficult. Like, how do I know that it's going up or down?

When should I get in a trade?

Even more importantly, can you deal with the emotions of forex trading? Alan Farley, a trading expert, rightly observes that mastering the emotions of trading is more difficult than mastering the technical skills. You’ll soon find out what he means by that.

The next concept that you need to understand is the concept of leverage. It’s a lot like margin in stock trading, only on steroids. It’s a simple concept. If you have $10,000 to trade with, your forex broker will let you borrow money from him so that you can trade in larger quantities. They will let you borrow as much as 400 times (400:1) what you put up in a trade. Most brokers allow between 50:1 and 100:1 margin. So, if you put up $1,000, and your broker allows 100:1 margin, then you’ll be trading $100,000 worth of currency (instead of $1,000).

That’s important, because every pip equals a certain dollar amount. When you trade $10,000, each pip movement equals $1. The chart below shows how it goes from there.

If you trade 1,000,000 worth of currency, each movement would be equal to $100. So if you bought at 1.1445 and sold at 1.1545, you would make 100 x $100, or $10,000. Now, I don't know about you, but I could live off of that much.

That's not saying, however, that you can make $10,000 per day. Of course it's possible, but there are a lot of factors that make it very difficult. Like, how do I know that it's going up or down?

When should I get in a trade?

Even more importantly, can you deal with the emotions of forex trading? Alan Farley, a trading expert, rightly observes that mastering the emotions of trading is more difficult than mastering the technical skills. You’ll soon find out what he means by that.

The information contained in this document, although highly entertaining and quite instructive, might lead you to believe that tomorrow you’re going to be a millionaire. You are not going to be a millionaire tomorrow. Well…that’s technically not correct. Because you could be a millionaire already, in which case tomorrow you’re guaranteed to be one.

- Strategy: Low-risk, High-return Forex Trading

- The Four Groups

- The Basics

- Pips

- Greed

- Revenge

- A Different Strategy

- 10 Principles

- The Daily Routine